UAE Freezone Company Formation

Looking to establish your business in the UAE without mainland complexity? Freezone company formation in the UAE offers the perfect solution. With over 45 specialised free zones across Dubai and other emirates, you can launch your business with 100% ownership, zero corporate tax on qualifying income, and complete operational freedom in as little as 5-10 business days.

The UAE processed over 24,000 new free zone licenses in 2024 alone.

Why Choose Free Zone Company Setup in the UAE

100% Foreign Ownership with Complete Control

Zero Tax on Qualifying Business Income

Strategic Global Business Location

Cost-Effective Setup with Flexible Options

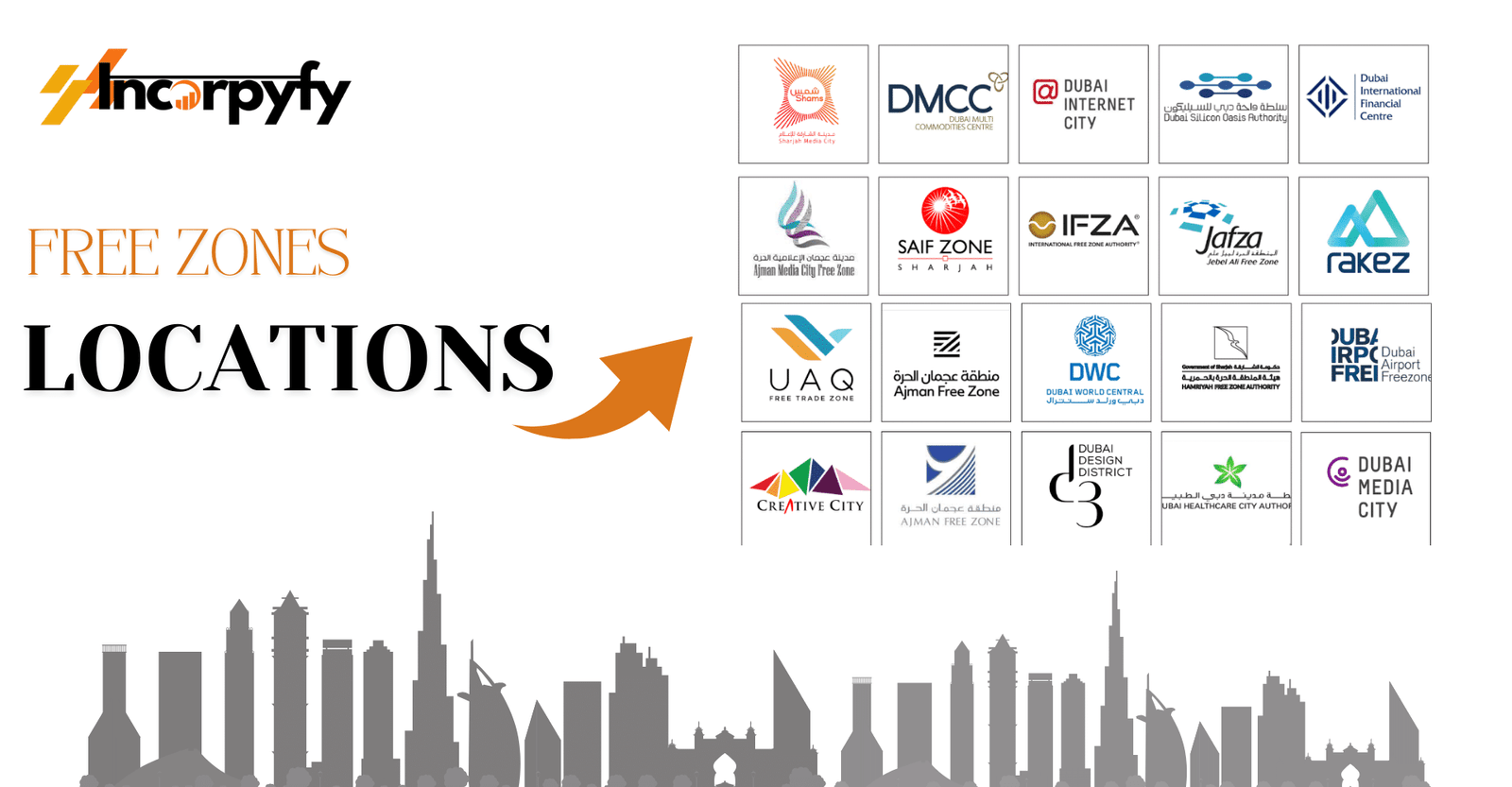

Free Zone Locations in the UAE

Understanding Free Zone Business Setup in UAE

What is a Freezone Company?

A freezone company operates within designated economic zones with their own regulatory frameworks separate from mainland jurisdiction. Think of free zones as business parks with special rules designed to attract international investment.

Each free zone has its own authority handling licensing, visas, and compliance. The tradeoff: free zone companies can’t do direct business with the UAE local market. You can trade internationally, do business with other free zone companies, and serve UAE customers through a local distributor.

Free Zone vs Mainland: Making the Right Choice

-

Choose free zone company formation in the UAE when:

- Your business is export-oriented or serves international markets

- You provide B2B professional services (consulting, IT, marketing)

- You run e-commerce without local retail needs

- You want minimal setup costs and faster processing

- Tax optimisation is a priority Choose mainland when:

- Your business targets local consumers directly

- You want to bid on government contracts

- You plan significant local market operations Most consultants, digital agencies, trading companies, and international service providers choose freezone company formation. Retailers, restaurants, and local service providers go to the mainland.

You need walk-in retail customers in the UAE

Types of Free Zone Structures

-

Free Zone Establishment (FZE): Single shareholder structure is perfect for solo entrepreneurs. You have complete control and full liability protection. Best for consultants, freelancers, and small service businesses.

Free Zone Company (FZ-LLC): Allows 2-5 shareholders, depending on the zone. Perfect for partnerships and businesses with multiple founders. Each shareholder has limited liability protection.

Branch of Foreign Company: Already operating internationally? Register a branch in a UAE free zone. Your parent company remains liable, simplifying accounting and governance.

Step-by-Step Freezone Company Registration Process

Step 1: Choose Activities and Free Zone (Day 1-3)

Select up to 3-6 business activities (varies by zone). Your activities determine which free zones accept your application, the license type needed, and the office requirements. Be comprehensive but specific. Adding activities later costs AED 2,000-5,000 extra.

Popular zones for different industries:

- General trading/e-commerce: IFZA, Meydan, RAKEZ

- Professional services: SHAMS, Meydan

- Tech/digital: Dubai Internet City, Dubai Silicon Oasis

- Logistics/warehousing: JAFZA, Dubai Airport Free Zone

- Corporate headquarters: DMCC, DIFC

Timeline: 1-3 days Cost: Free consultation

Step 2: Reserve Company Name (Day 3-4)

Submit 3 name options complying with freezone naming rules. Names can’t include restricted terms, conflict with trademarks, or be misleading. Most zones approve within 1-2 days.

Timeline: 1-2 days Cost: AED 200-600

Step 3: Prepare Documentation (Day 4-6)

For individuals: Passport copy (valid 6+ months), passport photos, current visa/entry stamp, and address proof.

For corporate shareholders: Certificate of incorporation, MOA, board resolution, UBO declarations, and good standing certificate.

Foreign documents need attestation: home country notary, UAE embassy in your country, UAE Ministry of Foreign Affairs (2-4 weeks).

Timeline: 2-5 days collection, 2-4 weeks attestation if needed. Cost: AED 500-2,000 for attestation

Step 4: Secure Office Space (Day 5-7)

Flexi-desk (AED 5,000+/year): Shared workspace, perfect for 1-2 person operations.

Dedicated office (AED 15,000-35,000/year): Private space for small teams.

Warehouse (AED 40,000+/year): Industrial spaces for manufacturing or storage.

Your visa allocation depends on office size. Larger spaces qualify for more employee visas.

Timeline: 1-3 days Cost: Based on selection

Step 5: License Issuance (Day 7-12)

Submit the compiled application to the free zone authority. They review and issue your freezone trade license in the UAE. Processing varies: IFZA and Meydan (2-3 days), DMCC (5-7 days), specialised zones (7-10 days).

Timeline: 2-7 days Cost: AED 10,000-25,000 depending on zone

Step 6: Visa Processing (Day 12-35)

Create an establishment card linking your company to immigration. Apply for investor/employee visas, including medical tests (AED 300-500), Emirates ID (AED 370), and visa processing (AED 2,000-3,000).

Timeline: 2-4 weeks Cost: AED 3,000-5,000 per visa

Step 7: Corporate Banking (Day 20-60)

Banks require comprehensive business plans, proof of activities, source of funds documentation, and economic substance proof. Apply to 2-3 banks simultaneously. Commercial banks (Emirates NBD, ADCB) approve faster than international banks.

Timeline: 2-8 weeks Cost: AED 5,000-25,000 minimum deposit

Total realistic timeline: 6-10 weeks from start to full operation.

Popular Free Zones for Company Formation in Dubai

IFZA (International Free Zone Authority)

Located in Fujairah with packages starting at AED 12,000. Fast processing (3-5 days), minimal paperwork, accepts most activities. The downside: 90 minutes from Dubai.

Best for: Budget-conscious entrepreneurs, general trading, consultancies, and startups.

Meydan Free Zone

Dubai-based with costs starting at AED 16,000-20,000. Specialises in service businesses and professional activities. Fast processing (5-7 days) with flexible packages.

Best for: Consultants, small agencies, professional services, and solo entrepreneurs wanting a Dubai address.

DMCC (Dubai Multi Commodities Centre)

Premium choice in Jumeirah Lakes Towers. Costs AED 25,000-35,000+ but offers impressive facilities, strong banking relationships, and an excellent reputation. Allows up to six activities under one license.

Best for: Commodity trading, corporate headquarters, businesses needing prestige.

RAKEZ (Ras Al Khaimah Economic Zone)

Located 45 minutes from Dubai, RAKEZ excels in industrial and manufacturing. Warehouse spaces are abundant and affordable among the UAE’s lowest license costs.

Best for: Manufacturing, warehousing, industrial operations, trading with inventory.

SHAMS (Sharjah Media City)

Sharjah-based, specialising in media, consultancy, and creative industries. Exceptional value starting at AED 13,000-15,000. Investors get three business activities free of cost. Just 20-30 minutes to Dubai.

Best for: Media companies, creative agencies, consultancies, freelancers, startups.

Free Zone Trade License Cost in the UAE

Total First-Year Investment in Dubai

| Setup Category | License & Registration | Office / Space | Estimated Total (AED) | Ideal For |

|---|---|---|---|---|

| Budget Setup (IFZA, SHAMS) | AED 10,000 – 13,000 | AED 5,000 – 7,000 (Flexi-desk) | AED 15,000 – 20,000 | Startups, freelancers, consultants |

| Mid-Range Setup (Meydan, RAKEZ) | AED 15,000 – 18,000 | AED 8,000 – 12,000 (Shared / small office) | AED 22,000 – 30,000 | Growing businesses, SME owners |

| Premium Setup (DMCC, DIFC) | AED 25,000 – 35,000 | AED 15,000 – 25,000 (Dedicated office) | AED 35,000 – 50,000 | Corporate firms, global investors |

Additional Costs

| Category | Estimated Cost (AED) | Notes |

|---|---|---|

| Visa (per person) | 3,000 – 5,000 | Investor or employee visa; varies by zone |

| Bank Account | 5,000 – 25,000 | Minimum deposit requirement by bank (Emirates NBD, Mashreq, ADIB, etc.) |

License Types & Estimated Costs

| License Type | Purpose / Business Activity | Estimated Cost (AED) |

|---|---|---|

| Commercial License | Trading, import/export, retail, e-commerce | AED 12,000 – 25,000 |

| Professional License | Consulting, services, IT, marketing, education | AED 10,000 – 20,000 |

| Industrial License | Manufacturing, production, assembly | AED 20,000 – 40,000+ |

| E-Commerce License | Online business, digital platforms | AED 12,000 – 18,000 |

Key Benefits of UAE Free Zone Company Formation

100% Profit Repatriation

Every dirham earned can be taken out of the UAE without restrictions: no approvals needed, no limits on amounts or frequency. Your profits are yours to send anywhere, anytime. The UAE dirham is pegged to the USD, providing stability for international transactions.

Simplified Compliance

Free zone authorities handle most compliance centrally. One authority manages licensing, visas, and basic compliance instead of multiple government departments. Annual renewals are straightforward with minimal paperwork. Most zones offer online portals for renewals and service requests.

UAE Investor Visa Benefits

Your license allows you to sponsor yourself, family members (spouse, children, parents), and employees. Visa allocations depend on office size. Most setups qualify for 2-5 visas initially.

The investor visa grants residency rights, personal bank account access, driving license eligibility, and access to UAE healthcare and education. Many zones now offer 2-3 year validity, with some providing 5-year or lifetime visa options.

Corporate Tax and VAT Compliance

Since 2023, the UAE has introduced 9% corporate tax on profits above AED 375,000. Free zone companies meeting qualifying criteria often remain exempt, but corporate tax registration is still required.

If taxable turnover exceeds AED 375,000, VAT registration and quarterly filing are mandatory. Professional setup companies include these registrations in packages.

Essential Services for Freezone Business Setup Package

PRO Services and Government Liaison

PRO services handle visa applications/renewals, license renewals, Emirates ID processing, document attestation, and immigration changes. Costs run AED 5,000-15,000 annually.

Accounting and Bookkeeping

Proper accounting is mandatory for compliance, banking relationships, and tax filings. Professional services cost AED 5,000-20,000 annually, including monthly bookkeeping, quarterly VAT returns, annual statements, and audit support.

Financial Compliance (ESR, UBO, AML)

Economic Substance Regulations require specific businesses to prove a genuine UAE presence. UBO declarations identify ultimate owners. AML compliance involves customer due diligence and transaction monitoring. Professional support costs AED 3,000-10,000 annually.

VAT and Corporate Tax Filing

VAT returns are filed quarterly, and corporate tax returns are filed annually. Late filing triggers AED 1,000+ penalties. Filing services cost AED 2,000-8,000 annually for both combined.

Annual License and Visa Support

License renewals cost AED 10,000-20,000 annually. Visa renewals every 2-3 years at AED 3,000-5,000 per visa. Many companies offer maintenance packages (AED 15,000-30,000) covering all routine requirements.

Why Choose Incorpyfy for Freezone Company Formation

Expertise Across All Major Free Zones

We’ve completed 500+ free zone setups across DMCC, IFZA, Meydan, RAKEZ, SHAMS, and 20+ other zones. Our 95% bank approval success rate comes from proper application preparation.

Transparent All-Inclusive Pricing

No hidden fees or surprise charges. You’ll know your total investment before signing. We break down license fees, office costs, visa expenses, and optional services separately.

Fast-Track Processing

License issuance: 5-10 business days. Complete setup with visas: 7-14 days. Banking included: 6-10 weeks total (banking timeline bank-dependent).

End-to-End Support

We stay through bank account opening, visa processing, office activation, compliance setup, and first-year renewals. Dedicated consultants handle everything while keeping you informed.

Multilingual On-Ground Team

Dubai-based team speaking English, Arabic, Hindi, Urdu, and French. We navigate government departments daily with established relationships, solving problems quickly.

Additional Frequently Asked Questions

What is the difference between FZE and FZ-LLC in the UAE?

FZE (Free Zone Establishment) is for single shareholders, giving you complete control like a sole proprietorship with limited liability. FZ-LLC (Free Zone Limited Liability Company) allows 2-5 shareholders, depending on the zone, perfect for partnerships. Both structures offer 100% foreign ownership and limited liability protection. Choose FZE if you’re a solo entrepreneur, and FZ-LLC if you have business partners or multiple investors.

Which free zone is the cheapest for company formation in the UAE?

IFZA (Fujairah) and SHAMS (Sharjah) are the most cost-effective, with packages starting from AED 11,900-13,000, including license and flexi-desk. RAKEZ (Ras Al Khaimah) also offers competitive rates at AED 13,500-15,000. While these zones cost 30-40% less than Dubai-based zones like DMCC or Meydan, they’re located outside Dubai. If you need a Dubai address specifically, Meydan Free Zone offers the best value starting at AED 16,000-18,000.

Can I change my business activities after getting the license?

Yes, you can add or remove activities by submitting an amendment application to your free zone authority. Adding activities typically costs AED 2,000-5,000 per activity plus amendment fees (AED 1,000-3,000). The process takes 3-7 days. However, removing activities usually doesn’t reduce your license fee. It’s better to include all potential activities during initial setup to avoid amendment costs later.

Do I need to visit the UAE personally for a freezone company setup?

Not necessarily. You can complete 80% of the process remotely through a power of attorney. Most free zones accept notarised documents and digital submissions. However, you’ll likely need one visit for corporate bank account opening, though some banks (Emirates NBD, ADCB) now offer video KYC for simple business models. Visa stamping also requires physical presence in the UAE, which typically takes 2-3 days.

What is qualifying income in the UAE free zones?

Qualifying income refers to revenue that remains exempt from the 9% UAE corporate tax. To qualify, your free zone company must derive income from qualifying activities (listed in Cabinet Decision No. 55 of 2023), maintain adequate substance in the UAE (real office, adequate employees, core activities conducted in the UAE), not elect to be subject to corporate tax, and comply with all transfer pricing regulations. Most legitimate free zone businesses with proper substance meet these criteria.

Can I work for my own free zone company on an investor visa?

Yes, an investor visa allows you to work for your own company without needing a separate work permit. You’re listed as the company owner/manager and can perform all business activities. However, you cannot work for other companies on an investor visa. If you want to work elsewhere while running your business, you’d need employment visa sponsorship from that other company.

How many employees can I hire with a free zone license?

Your visa quota depends on your office size and business activity. Flexi-desk spaces typically allow 1-2 visas, small offices (15-20 sqm) qualify for 3-5 visas, medium offices (30-50 sqm) get 6-10 visas, and large offices (50+ sqm) can sponsor 15+ visas. You can increase your quota by upgrading office space or applying for additional quota based on business growth and revenue. Each free zone has specific policies.

What happens if my free zone company doesn't meet economic substance requirements?

Non-compliance with Economic Substance Regulations (ESR) results in penalties starting at AED 10,000 for the first offence, AED 50,000 for the second offence within three years, and potential license suspension or cancellation for continued non-compliance. ESR applies mainly to specific activities: banking, insurance, investment fund management, lease-finance, headquarters, shipping, holding companies, intellectual property, and distribution centres. If your business falls in these categories, you must prove adequate presence, qualified employees, and core income-generating activities in the UAE.

Can I transfer my free zone company to another free zone?

Not directly. There’s no “transfer” mechanism between free zones since each operates independently. You’d need to cancel your current license and apply for a fresh one in the new zone, essentially starting over. This means new license fees (AED 10,000-25,000), new office lease, visa cancellations and reapplications, new bank account documentation, and business interruption during transition. Only consider this if the new zone offers significant long-term advantages.

Is auditing mandatory for free zone companies?

It depends on your free zone and revenue. Many free zones require annual audits for companies with revenue above AED 1 million or those with certain activities (trading, manufacturing). Some zones, like DMCC, require audits for all companies regardless of size. Audit costs range from AED 5,000 to 15,000 annually, depending on transaction volume and complexity. Even if not mandatory, banks often require audited financial statements for account maintenance and credit facilities.

Ready to Begin? Start Your Business Journey Today!

Unlock Business Success: Take the First Step with Our Expert Guidance Towards Your Entrepreneurial Dreams.