Freezone Business Setup in Dubai, UAE

Start your business journey today with Incorpyfy and tap into the endless possibilities of Freezone Company setup in Dubai, UAE. Our experts ensure a smooth, hassle-free process, helping you take advantage of Dubai’s thriving business environment. Let us handle the details while you focus on seizing new opportunities in one of the world’s most dynamic markets.

Dubai free zone company setup

Distinctive Benefits of Forming a Company in a UAE Free Zone

If you’re looking for a hassle-free way to launch your venture in the UAE, a free zone company setup in Dubai is hard to resist. With 0% corporate and personal income tax, these specialized zones offer a major financial boost, letting you save on overhead and reinvest in growth. Whether you’re in high-tech, logistics, manufacturing, or professional services, Dubai’s free zones provide a streamlined licensing process with minimal red tape—often faster than mainland or offshore setups. You also benefit from lower operational costs, a strategic location connecting you to regional and global markets, and plenty of incentives tailored to your business’s needs. It’s this blend of convenience, efficiency, and growth potential that makes Dubai free zones a go-to choice for forward-thinking entrepreneurs ready to tap into the region’s lucrative opportunities

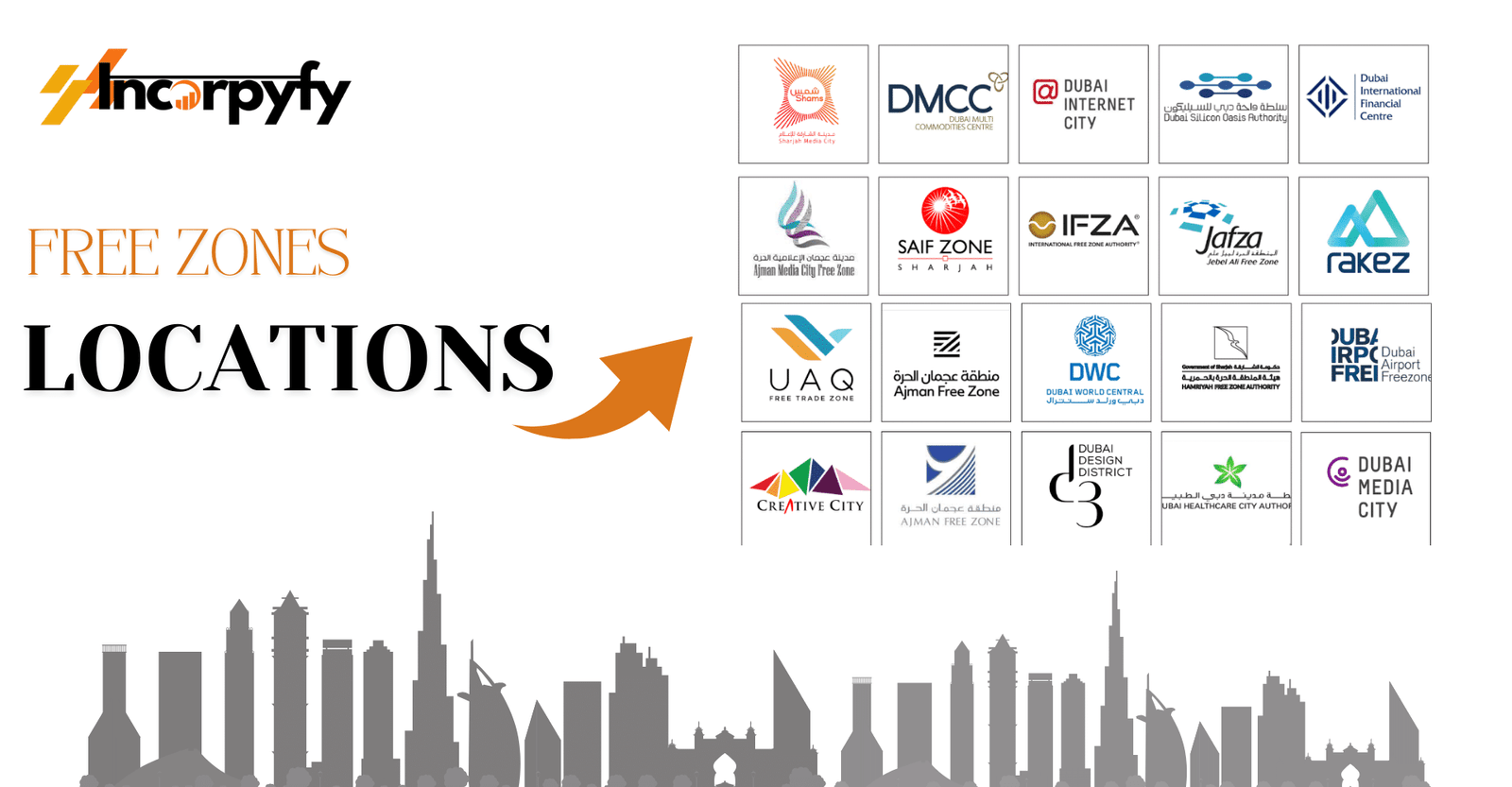

Best UAE Free Zones

We Recommend Only the Top-Rated and Most Esteemed Free Zones in the UAE

With over 45 Free Zones in the UAE, each offering unique benefits, choosing the right one can feel overwhelming. From varying setup costs and business activities to facility options and capital requirements, it’s not a one-size-fits-all decision. That’s where we come in. At Incorpyfy, we make the process simple. Our experts take the time to understand your industry, operational needs, and long-term goals, guiding you toward the best Free Zone to match your vision.

We know that success starts with the right foundation. That’s why our team handles everything—from ensuring compliance and securing licenses to navigating approvals—so you can focus on what really matters: growing your business. With our deep knowledge of Free Zone company setup in Dubai and across the UAE, we’ll help you unlock opportunities and position your business for lasting success in this thriving market.

Advantages of UAE Free Zones

Thinking about launching your business in the UAE? One of the smartest moves you can make is setting up in a free zone. The UAE’s free zones are designed to give businesses every opportunity to thrive, with a host of benefits that help you hit the ground running and keep growing. Here’s why you should seriously consider it:

Significant Tax Benefits

Who doesn’t love saving on taxes? Setting up in a UAE free zone means you’re exempt from corporate and personal income taxes, as well as import and export duties. That’s a huge win for cutting down operational costs and boosting profitability. More money stays in your business, letting you focus on scaling up and reinvesting where it matters most.

100% Ownership – No Local Partner Needed

One of the standout perks is that you can own your business outright. Unlike mainland companies that require a local partner, free zones allow 100% foreign ownership. This means you’re in full control – no need to share profits or decision-making with anyone else.

Easy Access to UAE Residence Visas

Setting up in a free zone also opens the door to UAE residence visas for you, your family, and even your employees. It’s a fantastic way to live and work in one of the most vibrant and cosmopolitan countries in the world.

No Trade Barriers or Quotas

Free zones offer businesses the freedom to trade without the hassle of quotas or trade barriers. This makes international trade smoother and more efficient. Whether you’re importing goods or exporting products, you can do so without unnecessary restrictions.

Full Repatriation of Capital and Profits

Worried about getting your money out? No problem. In UAE free zones, you can repatriate 100% of your capital and profits. This makes managing your finances easy and stress-free, letting you reinvest and grow your business without limitations.

Simplified Import and Export Processes

Navigating import and export policies can be a headache elsewhere, but not in the UAE’s free zones. The policies are straightforward and business-friendly, ensuring seamless trade and logistics. It’s all about making your operations as smooth as possible.

Personal Income Tax? Not Here

The UAE’s tax-friendly environment extends to your personal earnings too. In free zones, there’s zero personal income tax, which makes it an attractive place to work and build your future.

State-of-the-Art Infrastructure

Free zones in the UAE offer world-class facilities. From sleek, modern office spaces to advanced telecommunication systems and top-notch logistics networks, the infrastructure is designed to support businesses of all sizes. Whether you’re running a tech startup or a large enterprise, the environment is set up for success.

Hire Talent Without Restrictions

Free zones let you recruit the best talent from around the globe. There are no restrictions on hiring expatriates, so you can build a diverse and skilled team that fits your business needs perfectly.

Prime Locations for Global Reach

Location is everything in business, and many of the UAE’s free zones are strategically positioned near major ports, airports, and key transport hubs. This makes distributing goods across regional and global markets faster and more efficient.

A Stable and Supportive Environment

Beyond the direct benefits, free zones place your business in a stable, thriving economy with a government that actively supports growth and innovation. The UAE is known for its economic stability, making it a safe and lucrative place to invest and expand.

Steps to Setup a Business Setup in a Free Zone

If you’re considering launching your venture in the United Arab Emirates (UAE), setting up a free zone business can be a fantastic option. Free zones not only offer attractive incentives but also simplify many steps of the company formation process. In this guide, we’ll walk you through the major milestones—from choosing the right legal structure to securing office space—so you can confidently kick-start your free zone journey.

Pick the Perfect Legal Structure for Your Business

Before you do anything else, it’s crucial to determine which legal form of business best suits your goals. Depending on the free zone, you might form a Free Zone Establishment (FZE), a Free Zone Company (FZC), or open a Branch office. Each structure comes with its own perks and requirements, so it’s important to consider everything from ownership rules to capital needs before making your choice.

Choose a Name That Fits—And Gets Approved

Once you’ve settled on your business structure, you must choose a company name that follows the free zone’s specific naming guidelines. Think of something that resonates with your brand but also meets the UAE’s naming rules. Once you have your shortlist, you’ll submit it to the relevant free zone authority for approval. This step is often quick, but getting it right from the start is important.

Pro Tip: Make sure your chosen name is easy to pronounce and reflects your company’s values—this will help your brand stand out in a competitive market.

Secure the Right Trade License

A trade license basically spells out the specific activities your company can carry out. To apply, you’ll typically submit a Memorandum and Articles of Association, along with details about shareholders and the nature of your business. Getting the correct trade license is essential because operating outside its scope can lead to hefty penalties or complications down the line.

Find and Lock Down Your Office Space

Most free zones offer flexible options, from smaller workstations to larger commercial units. You must have a physical office within the free zone, so pick a space that aligns with your business size and future growth plans. If unsure where to start, your free zone authority often points you toward suitable office space options.

Complete Pre-Approvals and Final Registration

Depending on your industry, you might need pre-approvals from other government entities (like health or environmental authorities). Once you’ve ticked those boxes, you can move on to your business registration with the free zone authority. At this point, you’ll receive your final incorporation documents and be fully authorized to operate.

Why an Expert’s Guidance Is Worth It

Free zone regulations can feel overwhelming, especially if you’re new to the UAE market. Working with experienced consultants or legal professionals—who know the free zone’s specific requirements—can save you time, help you stay compliant, and make sure everything moves smoothly. From clarifying documentation to streamlining the business setup process, professional advice is often worth its weight in gold.

Ready to Begin Your Free Zone Journey?

Launching a free zone company in the UAE is a strategic move that can open up a world of business opportunities. By taking the time to pick the right legal structure, secure a fitting office, and nail the correct trade license, you’ll set the foundation for a successful venture. If you need any help, we’re here to guide you step by step—ensuring that you comply with all UAE free zone regulations and enjoy a smooth, stress-free setup.

Documents Required to Start a Business in Free Zone

If you’re thinking about setting up a company in a free zone in the UAE, you’ll soon find out that there’s a bit of paperwork involved. While different free zones (and different business activities) may have their own requirements, here’s a handy overview of the core documents you’ll likely need. If you’re worried about the process, don’t stress—an experienced consultant can ensure everything goes smoothly. Let’s dive right in!

1. Essential Company Documents

When registering a new company in a UAE free zone, you’ll often start by providing standard documents outlining the structure and ownership of your business. These may include:

- Memorandum and Articles of Association (MOA): This defines your company’s scope and internal regulations.

- Details of Shareholders (with passport copies): It’s crucial to prove who owns the company.

- Board Resolution (if applicable): Required if a board of directors is making key decisions.

- Certificate of Incorporation or Registration (for existing companies): A piece of evidence that your business is already legally formed somewhere else.

2. Trade License Application

Your trade license is the lifeblood of your operations, as it specifies what activities you’re allowed to engage in. Here’s what you might be asked for:

- Trade License Application Form: You’ll fill in important info about your business activity and structure.

- Business Description: A concise summary of what you plan to do.

- Company Name Options: Usually, you’ll need to submit at least three potential names for approval.

- Office Space Proof: A Tenancy Agreement or Letter of Intent showing that you have a physical location within the free zone.

3. Personal Documents

To keep things transparent, free zones will ask for personal identification details from all shareholders and managers:

- Passport Copies: Make sure they’re valid and clear.

- Resume/CV: Demonstrates the experience and credibility of each key individual.

- Residence Proof (for non-citizens): A utility bill or similar document is typically used.

4. Detailed Business Plan & Financial Paperwork

Depending on the free zone, you may have to show that your business idea is sound and you have the funds to back it up:

- Business Plan: Outline your goals, target market, operations strategy, and unique selling points.

- Financial Forecasts: Show you’ve crunched the numbers and can project revenue and expenses.

- Bank References or Proof of Funds: Demonstrate you have enough capital to operate.

- Audit Report (for existing companies): Confirms your financial standing over a certain period.

5. Additional Documents (When Applicable)

Certain scenarios and industries may require extra permissions or paperwork:

- NOC from Sponsor: If your sponsor is a mainland-registered company, you might need a No-Objection Certificate.

- Power of Attorney: If you authorise someone else to act on your behalf.

- Industry-Specific Licenses (e.g., healthcare, education): Essential if operating in a regulated field.

- Special Permits: Some business activities—like import/export of specific goods—may need special approvals.

6. Keep in Mind: Requirements Can Vary

Each free zone has its regulations, so the exact documents might differ. Some free zones may require attestation, legalization, or Arabic translation. Others might want additional endorsements from government authorities. That’s why having a trusted consultant can save you both time and effort.

Why Professional Guidance is Worth It

Navigating the UAE free zone company setup process isn’t always straightforward. Our seasoned consultants know the ins and outs of different free zones and can guide you on every detail—from drafting the right documents to securing that final stamp of approval. With the right support, you’ll avoid common pitfalls, speed up the process, and stay fully compliant with local regulations.

Ready to Get Started?

We’d love to help you launch your dream venture in a UAE free zone—just reach out, and we’ll take the confusion out of the paperwork, leaving you free to focus on your new business.

If you’re feeling overwhelmed by the documentation requirements or simply want expert advice, don’t hesitate to get in touch. We’re here to make company formation in a UAE free zone as smooth as possible. Together, we’ll ensure you tick all the right boxes—and get you closer to opening your doors for business.

Why Choose Incorpyfy as Your Partner for Company Formation in UAE Free Zones

At Incorpyfy, we take pride in being a leading business consultancy firm with the expertise to guide you through the intricate process of company formation in the UAE’s free zones. Our seasoned consultants are here to provide comprehensive support, ensuring you have a smooth experience every step of the way. We also extend our services beyond the UAE, helping businesses establish themselves in Saudi Arabia and other parts of the Middle East.

Whether you’re looking for mainland company formation in the UAE, want to leverage opportunities in Abu Dhabi’s emerging free zones, or need help with offshore business setup, our team is committed to making the journey as seamless as possible. From navigating local regulations to handling all necessary paperwork, we tailor our solutions to match your unique needs.

Our client-focused approach and commitment to excellence have made Incorpyfy a trusted partner for entrepreneurs aiming to succeed in this dynamic region. Backed by a dedicated team working tirelessly to secure your venture’s future, we’re here to put your business on track for growth and success in the Middle Eastern market.

What are the benefits of setting up a company in Dubai free zones?

Setting up a company in Dubai free zones comes with numerous perks designed to boost your business growth. Key benefits include 100% foreign ownership, 0% corporate and personal tax, full profit repatriation, and no import or export duties. Free zones offer easy business setup, streamlined processes, and access to world-class infrastructure. Plus, you gain proximity to global markets, thanks to Dubai’s strategic location and excellent connectivity.

How do I start a business in a Dubai free zone?

Starting a business in a Dubai free zone is simple. First, choose the right free zone based on your business activity. Next, select the type of license – whether commercial, industrial, or professional. Submit the required documents, such as passport copies, application forms, and a business plan. Once approved, obtain your business license, secure office space, and open a corporate bank account. Our team can help you navigate each step for a seamless business setup in Dubai free zones.

What is the cost of free zone company formation in Dubai?

The cost of free zone company formation in Dubai varies depending on the free zone, license type, and office space requirements. Generally, setup costs start from AED 12,500 and can go up based on your business needs. Factors like visa allocations, warehouse facilities, and specific permits can influence the overall price. We recommend consulting with experts to get a tailored cost estimate that aligns with your goals.

Which free zone is best for my business in Dubai?

Choosing the best free zone in Dubai depends on your industry and business requirements. For tech and media companies, Dubai Internet City and Dubai Media City are ideal. If you’re in logistics, Jebel Ali Free Zone (JAFZA) is a top choice. Professional services thrive in Dubai Multi Commodities Centre (DMCC), while Dubai Silicon Oasis is great for innovation and tech startups. Each free zone offers unique benefits, so selecting the right one is key to your success.

What documents are required for free zone company setup in Dubai?

To set up a company in a Dubai free zone, you’ll typically need:

- Passport copies of shareholders and directors

- Application form and business plan

- Proof of address and NOC (if required)

- Memorandum of Association (MOA) and Articles of Association (AOA)

- Share capital information (for certain zones)

- Lease agreement for office space

Additional documents may be required depending on the type of business license and free zone regulations.

Can I operate outside the free zone in Dubai?

Generally, companies established in Dubai free zones are restricted to operating within the free zone or international markets. However, if you wish to operate directly in Dubai’s mainland, you’ll need to partner with a local distributor or establish a branch on the mainland. Alternatively, applying for a dual license can allow operations beyond the free zone, providing greater flexibility.

How long does it take to set up a free zone company in Dubai?

The free zone company setup process in Dubai is quick and efficient, often taking as little as 2 to 4 weeks. Some free zones even offer instant licenses that can be processed within days. Factors like the completeness of documents, visa processing, and specific business requirements can influence the timeline.

What types of licenses are available in Dubai free zones?

Dubai free zones offer a variety of licenses to cater to different industries, including:

- Commercial License – For trading and general business activities

- Service License – For professional services like consulting, IT, and marketing

- Industrial License – For manufacturing and production

- Freelance Permit – For independent professionals and sole practitioners

Choosing the right license depends on your business activities and long-term goals.

Ready to Begin? Start Your Business Journey Today!

Unlock Business Success: Take the First Step with Our Expert Guidance Towards Your Entrepreneurial Dreams.