Freezone Business Setup in Dubai, UAE

Unlock the potential of your business venture with Incorpyfy’s seamless Freezone company formation in Dubai, UAE. Our expert services ensure a smooth setup process, empowering you to thrive in the dynamic business landscape of the Emirates.

Experienced Team

Satisfied Clients

Project Complate

12 YEARS OF EXPERIENCE

Free Zone Business set up in Dubai

Distinctive Benefits of Forming a Company in a UAE Free Zone

When individuals and institutions explore the options for company formation in the United Arab Emirates, the attraction of free zones emerges as a compelling factor. These designated business zones offer a unique advantage – a corporate and personal income tax rate of 0%, providing a significant financial incentive for businesses to thrive. Choosing the ideal free zone is a strategic decision that requires careful consideration of various factors, including the nature and type of business, the size and availability of office space, location, and pricing. With experts’ guidance, obtaining a business license for a Dubai free zone company setup can be a streamlined and efficient process that is faster than offshore and mainland incorporation alternatives.

From high-tech industries to manufacturing, logistics, and professional services, free zones provide a conducive environment for companies to operate with minimal bureaucracy, reduced operational costs, and a host of incentives and benefits. These dedicated zones also facilitate seamless access to regional and global markets, enabling businesses to leverage the UAE’s strategic location and capitalize on lucrative trade opportunities.

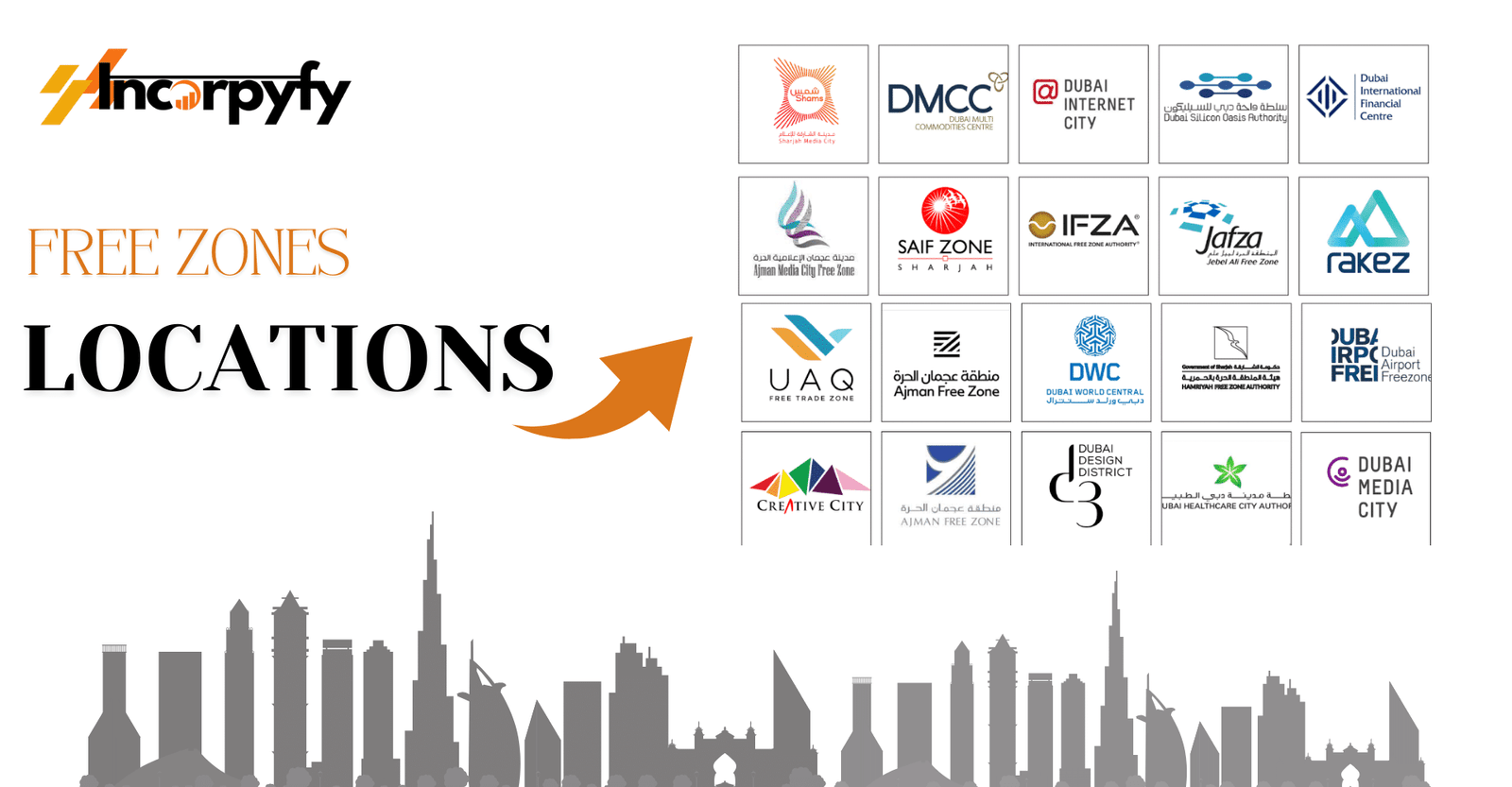

Best UAE Free Zones

We Recommend Only the Top-Rated and Most Esteemed Free Zones in the UAE

The United Arab Emirates boasts an impressive array of over 45 different Free Zones, each offering unique advantages and catering to diverse business needs. Choosing the right Free Zone can be daunting with varying setup costs, permitted business activities, facilities options, and share capital requirements. At Incorpyfy, we understand the complexities involved, and our team of experts is dedicated to simplifying this process, saving you valuable time and resources. We carefully evaluate your industry, operational requirements, and long-term goals to provide tailored recommendations on the best place to register your business within the UAE’s thriving Free Zone ecosystem.

Our team at Incorpyfy takes a comprehensive approach, considering all relevant factors to ensure your business is positioned for growth and success. We meticulously navigate the intricate landscape of Free Zones, ensuring compliance with regulations and obtaining necessary licenses and approvals. By partnering with us, you gain access to our extensive network and resources, enabling you to tap into the vast opportunities presented by the UAE’s dynamic business environment.

Advantages of UAE Free Zones

Setting up your business in a UAE free zone offers numerous advantages that can contribute to your venture’s growth and success. Here are some of the key benefits of setting up your company in a UAE free zone:

Minimized Taxation

UAE free zones offer attractive tax incentives, including exemption from corporate and personal income taxes and exemption from import and export duties. This can significantly reduce your operating costs and enhance your profitability.

100% Foreign Ownership

One of the most significant advantages of free zones is owning 100% of your company without needing a local sponsor or partner. This allows you to control your business operations and decision-making processes completely.

UAE Residence Visa

By setting up your business in a UAE free zone, you can obtain a UAE residence visa, enabling you and your family to enjoy the benefits of living and working in this dynamic and cosmopolitan country.

No Trade Barriers or Quotas

UAE free zones offer a business-friendly environment with no trade barriers or quotas, allowing you to engage in international trade and commerce without restrictions.

100% Repatriation of Capital and Profits

UAE free zones permit the full repatriation of capital and profits, allowing you to manage your finances and reinvest your earnings as you see fit.

Simple Import and Export Policies

The import and export policies within UAE free zones are streamlined and straightforward, facilitating efficient trade and logistics operations.

No Personal Income Taxes

UAE free zones offer exemption from personal income taxes, providing a tax-friendly environment for you and your employees.

Extensive Infrastructure and Facilities

UAE free zones boast world-class infrastructure, including modern office facilities, state-of-the-art telecommunications systems, and efficient logistics and transportation networks, ensuring a conducive environment for business operations.

No Restrictions on Hiring Expatriates

UAE free zones offer flexibility in hiring practices, allowing you to recruit skilled professionals worldwide without restrictions.

Strategic Location

Many UAE free zones are strategically located, providing easy access to major transportation hubs, such as airports and seaports, facilitating efficient logistics and distribution to regional and global markets.

By leveraging the advantages of UAE free zones, you can position your business for success in a dynamic and supportive environment while benefiting from the UAE’s renowned economic stability, modern infrastructure, and strategic location.

Steps to Setup a Business Setup in a Free Zone

Setting up a business in a free zone in the UAE follows a structured process. Here are the key steps to set your business in a free zone:

Determine the Suitable Legal Structure for Your Business

The first step is determining the appropriate legal structure for your business. Free zones offer various options, such as Free Zone Establishment (FZE), Free Zone Company (FZC), or Branch office. Each structure has its advantages and requirements, so choosing the one that best suits your business goals and needs is essential.

Select an Appropriate Name for Your Business

Once you have decided on the legal structure, you must select a name for your business or entity. Free zones have specific naming conventions and guidelines, and the relevant authorities must approve the chosen name.

Secure the Necessary Business Trade License

A trade license is mandatory for operating a business in a free zone. This license specifies the activities your business is permitted to engage in. The application process involves submitting the required documents, such as the company’s memorandum and articles of association, shareholder information, and other relevant documents.

Identify and Secure Suitable Office Space

Most free zones offer a range of office spaces, from individual offices to larger commercial units. You will need to secure an office space within the free zone to establish your business premises. The free zone authorities can assist you in finding suitable office space that meets your requirements.

Fulfill Pre-Approval Requirements and Complete Business Registration

Before finalizing the registration process, you may need to obtain pre-approvals from various government authorities, depending on the nature of your business. Once all pre-approvals are in place, you can proceed with the official registration of your business with the free zone authority.

Throughout the process, it is advisable to work with experienced consultants or legal professionals who are well-versed in the specific requirements and regulations of your chosen free zone. We can guide you through the process, ensure compliance, and assist with any additional requirements or documentation needed for a smooth and successful business setup in the free zone.

Documents Required to Start a Business in Free Zone

Setting up a business in a free zone in the UAE requires submitting various documents to the relevant authorities. While the specific requirements may vary depending on the free zone and the nature of your business, here are some common documents that are typically required:

Company Documents

- Memorandum and Articles of Association (MOA)

- Shareholder details and passport copies

- Board of Directors’ resolution (if applicable)

- Certificate of Incorporation or Registration (for existing companies)

Trade License Application

- Completed trade license application form

- Description of business activities

- Proposed company name (multiple options)

- Proof of office space (lease agreement or letter of intent)

Personal Documents

- Passport copies of shareholders and managers

- Curriculum Vitae (CV) or résumés of shareholders and managers

- Proof of residence (if applicable)

Business Plan and Financial Documents

- Comprehensive business plan

- Financial projections and forecasts

- Bank references or proof of funds

- Audited financial statements (for existing companies)

Additional Documents (as applicable)

- No Objection Certificate (NOC) from the sponsor (for mainland companies)

- Power of Attorney (if required)

- Industry-specific licenses or approvals (e.g., for healthcare, education, etc.)

- Special approvals or permits (e.g., for certain types of activities or products)

It’s important to note that the document requirements may vary based on the specific free zone, the type of business activity, and the company’s legal structure. Some free zones may have additional requirements or require documents to be attested, legalized, or translated into Arabic.

To ensure a smooth and efficient business setup process, it is advisable to consult with our experienced professionals or consultants who specialize in free zone company formations. We can provide guidance on the specific document requirements, assist with preparing and submitting the necessary documents, and ensure compliance with all relevant regulations and procedures.

Why Choose Incorpyfy as Your Partner for Company Formation in UAE Free Zones

As a leading Business Consultancy Firm, Incorpyfy specializes in professionally handling the intricate procedures involved in company formation within the UAE’s free zones. Our team of experienced consultants is dedicated to providing comprehensive guidance and support to clients throughout the process.

Our extensive range of services caters to businesses seeking to establish a presence not only in the UAE but also in Saudi Arabia and other Middle Eastern countries. We offer tailored solutions for Mainland Company Formation in the UAE, enabling entrepreneurs and enterprises to capitalize on the region’s dynamic business landscape.

Incorpyfy’s expertise encompasses a wide array of services, including:

- Business Setup in Abu Dhabi Free Zones: We guide clients through the intricacies of establishing their businesses within Abu Dhabi’s thriving free zones, leveraging our in-depth knowledge of local regulations and requirements.

- Offshore Business Setup in UAE: We provide seamless offshore company formation services for businesses seeking to tap into the UAE’s strategic location and favorable tax environment, ensuring full compliance with all relevant laws and regulations.

With our client-centric approach and unwavering commitment to excellence, Incorpyfy has earned a reputation as a trusted partner for businesses navigating the complexities of company formation in the UAE and the broader Middle Eastern region. Our team of experts works tirelessly to ensure your venture is established on a solid foundation, paving the way for growth and success in this dynamic market.

What Types of Businesses are Permitted in UAE Free Zones?

In UAE free zones, you can conduct a wide range of business activities, including trading, import/export, manufacturing, service-based industries, consulting, IT and technology, media, and publishing. However, the specific business activities you can undertake may vary depending on the free zone you choose and the type of license you obtain.

What is the Process for Setting Up a Business in a Free Zone?

The general process for setting up a business in a free zone includes:

- Determining the legal entity type.

- Choosing a company name.

- Applying for a trade license.

- Securing office space.

- Obtaining necessary approvals and registrations.

- Fulfilling any additional requirements specific to your business or the free zone.

How Can I Select an Appropriate Trading Name, and Are There Any Naming Rules?

When choosing a trading name for your business in a free zone, you must follow the naming conventions and guidelines set by the respective free zone authority. Generally, the name should be unique, not already in use, and accurately represent your business activities. There may also be restrictions on certain words or phrases in the name.

Which are the Top 3 Low-Cost Free Zones in the UAE?

Some of the low-cost free zones in the UAE that offer competitive pricing and affordable office spaces include a) the Ajman Free Zone, b) the Ras Al Khaimah Economic Zone (RAKEZ), and c) the Umm Al Quwain Free Trade Zone.

Who are the Best Business Setup Consultants for UAE Free Zones?

While many business setup consultants exist in the UAE, Incorpyfy is widely regarded as one of the leading and most trusted consultants for free zone company formations. With years of experience and a team of experts, Incorpyfy can guide you through the entire process, ensuring compliance and a smooth setup.

Are Free Zone Registered Companies Required to Submit Audit Reports?

Yes, companies registered in UAE free zones are typically required to submit audited financial statements and an audit report on an annual basis. This is a mandatory requirement to maintain compliance with the free zone regulations and to ensure transparency in financial reporting.

Ready to Begin? Start Your Business Journey Today!

Unlock Business Success: Take the First Step with Our Expert Guidance Towards Your Entrepreneurial Dreams.